Australia’s top performing suburbs for 2021 for house & units

So, where were Australia’s top performers in residential real estate over 2021?

CoreLogic’s annual Best of the Best 2021 report is the most comprehensive overview of top performing residential markets and provides suburb-level insights across a variety of measures to reveal Australia’s strongest performers over the year.

The extraordinary momentum carried over from 2020, coupled with monetary and fiscal stimulus measures has contributed to an unprecedented year of growth and litany of outstanding results for the Australian residential housing market.

Australia’s housing market recorded outstanding capital growth over 2021, with the estimated value of residential real estate now $9.4 trillion; a new record high.

In the 12 months to 30 November, property values surged by 22.2% nationally, the largest annual increase since 1989. The synchronised upswing saw almost every capital city and rest of state region reach record high values, with the exceptions of WA and NT.

CoreLogic’s Head of Research Eliza Owen said that the strong housing market performance over the year was driven by multiple factors, including low interest rates, fiscal and institutional support for households, high household savings and relatively low levels of advertised stock.

“The popularity of regional Australia is reflected in many aspects of the Best of the Best report for 2021,” she said.

“The quiet coastal suburb of Yamba, in the Coffs Harbour-Grafton region of NSW, achieved the highest annual growth in units of suburbs across Australia, at 56.6%. Regional suburbs were represented in many of the top value growth tables, including Ocean Grove units in Geelong (up 41.7% in the year), Fraser Island units in Wide Bay (up 48.2%), and Campbell Town houses in Tasmania (up 50.5%).”

Rental value appreciation was also high over the year to November with national rents recording the highest annual growth rate since January 2008 at 9.4%. This was led by growth of 12.5% across the combined regional market, compared with 8.3% across the combined capital cities. Unlike 2020 however, rental market increases have become more broad-based. Even the Melbourne unit market, which saw a peak to trough decline in rents of -8.5% between March 2020 and May 2021, has seen a recovery trend, with rent values now 1.7% higher over the year.

The expansion of housing credit has also seen more elevated levels of potentially risky lending, which prompted a response from the banking regulator, APRA. Through October, the regulator announced changes to borrower serviceability assessment, which may slow credit growth moving forward, particularly in the investor segment.

Additionally, affordability has become a larger constraint on demand. The ratio of dwelling values to household incomes reached a new record high of 7.7 in June 2021, as did the number of years it takes to save a 20% home loan deposit (10.2 years).

It’s likely Australia’s property market has seen the peak of value increases as worsening affordability constraints, a surge in vendor activity and a recent tightening of housing finance conditions take effect. While providing an outlook for the 2022 market, Ms Owen noted the likelihood that sales and listings activity had also likely peaked.

“The constraints of slightly tighter credit conditions, the erosion of housing affordability and a higher level of listings being added to the market are expected to see softer growth rates across property values in 2022,” she said.

“These forces are an accumulation of headwinds for property market performance. Softer growth rates are likely to coincide with fewer purchases, where sales and listings activity eventually move with momentum in price.”

However, a slowdown in buyer and seller activity also mean a slowdown in debt accrual for Australian households. This may also mitigate the need for further interventions around risk in housing lending, following the increase to serviceability assessment buffers for borrowers by APRA in October.

This article provides a snapshot of some of the top 10 suburbs from CoreLogic’s 45-page Best of the Best report in 2021.

The Best of the Best 2021 highlights the top performing houses and units across Australia based on the following criteria:

- Highest Sales Across the Nation

- Highest Total Value of Sales

- Top 10 Highest and Lowest Median Value

- Top 10 Highest 12-month Change in Values

- Top 10 Highest 12-month Change in Rents

- Top 10 Highest Rental Yields

All data highlighted is current as at the 30 November 2021, with the exception of Total Value of Sales data which reflect sales that occurred over the 12 months to 30 September 2021. Learn more.

Australia’s top performers in the housing market, 2021

Australia’s Top 10 Suburbs…

Highest Median Values for 2021 across Capital Cities and Regional

Lowest Median Values for 2021 across Capital Cities and Regional

Quick snapshot of top suburb performers per State

NSW Best Performers for 2021

Highest Median Value

– HOUSES: Bellevue Hill, Eastern Suburbs, NSW: $8,736,643

– UNITS: Point Piper, Eastern Suburbs, NSW: $3,216,796

Lowest Median Value

– HOUSES: Hay, Murray: $148,499

– UNITS: Kooringal, Riverina: $236,117

Highest 12-month Change in Value

– HOUSES: Gerrigong, NSW – Illawara: 56.4%

– UNITS: Yamba, Coffs Harbour – Grafton: 56.6%

Highest 12-month Change in Rents

– HOUSES: Finley, Murray: 37.8%

– UNITS: Narooma, Capital Region: 33.7%

Highest Rental Yields

– HOUSES: Finley, Murray: 9.7%

– UNITS: Muswellbrook, Hunter Valley excl Newcastle: 7.2%

Highest 12-month Change in Values & Rents, Greater Sydney & Regional NSW

See more of New South Wales’ best performing areas

VIC Best Performers for 2021

Highest Median Value

– HOUSES: Toorak, Melbourne – Inner: $4,881,451

– UNITS: Ashburton, Melbourne – Inner East: $1,326,053

Lowest Median Value

– HOUSES: Murtoa, North West: $156,642

– UNITS: Numurkah, Shepparton: $204,015

Highest 12-month Change in Value

– HOUSES: St Andrews Beach, Mornington Peninsula: 58.6%

– UNITS: Ocean Grove, Geelong: 41.7%

Highest 12-month Change in Rents

– HOUSES: Tootgarook, Mornington Peninsula: 20.2%

– UNITS: Cowes, Latrobe – Gippsland: 21.8%

Highest Rental Yields

– HOUSES: Warracknabeal, North West: 8.7%

– UNITS: Numurkah, Shepparton: 6.2%

Highest 12-month Change in Values & Rents, Greater Melbourne & Regional VIC

See more of Victoria’s best performing areas

QLD Best Performers for 2021

Highest Median Value

– HOUSES: Sunshine Beach, Sunshine Coast: $2,414,687

– UNITS: Noosa Heads, Sunshine Coast: $1,455,208

Lowest Median Value

– HOUSES: Monto, Wide Bay: $128,281

– UNITS: Woree, Cairns: $158,846

Highest 12-month Change in Value

– HOUSES: Mermaid Beach, Gold Coast: 51.7%

– UNITS: Fraser Island, Wide Bay: 48.2%

Highest 12-month Change in Rents

– HOUSES: Clear Island Waters, Gold Coast: 28.3%

– UNITS: Noosa Heads, Sunshine Coast: 30.8%

Highest Rental Yields

– HOUSES: Collinsville, Mackay – Isaac – Whitsunday: 12.5%

– UNITS: Woree, Cairns: 10.7%

Highest 12-month Change in Values & Rents, Greater Brisbane & Regional QLD

See more of Queensland’s best performing areas

SA Best Performers for 2021

Highest Median Value

– HOUSES: Unley Park, Adelaide – Central and Hills: $1,958,302

– UNITS: Kent Town, Adelaide – Central and Hills: $561,649

Lowest Median Value

– HOUSES: Nangwarry, South Australia – South East: $129,477

– UNITS: Murray Bridge, South Australia – South East: $201,656

Highest 12-month Change in Value

– HOUSES: Beaumont, Adelaide – Central and Hills: 49.2%

– UNITS: West Lakes, Adelaide – West: 20.3%

Highest 12-month Change in Rents

– HOUSES: Port Elliot, South Australia – South East: 27.3%

– UNITS: Ascot Park, Adelaide – South: 15.2%

Highest Rental Yields

– HOUSES: Port Pirie West, Barossa – Yorke – Mid North: 9.2%

– UNITS: Salisbury, Adelaide – North: 6.9%

Highest 12-month Change in Values & Rents, Greater Adelaide

See more of South Australia’s best performing areas

WA Best Performers for 2021

Highest Median Value

– HOUSES: Dalkeith, Perth – Inner: $2,822,362

– UNITS: North Fremantle, Perth – South West: $771,064

Lowest Median Value

– HOUSES: Kambalda East, WA- Outback (South): $90,155

– UNITS: Orelia, Perth – South West: $176,480

Highest 12-month Change in Value

– HOUSES: South Carnarvon, WA – Outback (South): 55.5%

– UNITS: Orelia, Perth – South West: 35.7%

Highest 12-month Change in Rents

– HOUSES: Djugun, WA – Outback (North): 34.9%

– UNITS: Armadale, Perth – South East: 18.2%

Highest Rental Yields

– HOUSES: Kambalda West, WA – Outback (South): 14.7%

– UNITS: Orelia, Perth – South West: 8.1%

Highest 12-month Change in Values & Rents, Greater Perth

See more of Western Australia’s best performing areas

TAS Best Performers for 2021

Highest Median Value

– HOUSES: Sandy Bay, Hobart: $1,444,480

– UNITS: Hobart, Hobart: $865,243

Lowest Median Value

– HOUSES: Rosebery, West and North West: $147,186

– UNITS: Devonport, West and North West: $321,687

Highest 12-month Change in Value

– HOUSES: Campbell Town, Launceston & North East: 50.5%

– UNITS: Brighton, Hobart: 35.8%

Highest 12-month Change in Rents

– HOUSES: Bicheno, South East: 40.9%

– UNITS: Newnham, Launceston & North East: 16.9%

Highest Rental Yields

– HOUSES: Queenstown, West and North West: 8.7%

– UNITS: Brighton, Hobart: 5.3%

Highest 12-month Change in Values & Rents, Greater Hobart

See more of Tasmania’s best performing areas

NT Best Performers for 2021

Highest Median Value

– HOUSES: Fannie Bay, Darwin: $848,718

– UNITS: Bayview, Darwin,: $504,953

Lowest Median Value

– HOUSES: Katherine, Northern Territory – Outback: $338,269

– UNITS: Gillen, Northern Territory – Outback: $280,860

Highest 12-month Change in Value

– HOUSES: Moulden, Darwin: 32.6%

– UNITS: Rapid Creek, Darwin: 29.7%

Highest 12-month Change in Rents

– HOUSES: Anula, Darwin: 30.6%

– UNITS: Woolner, Darwin: 20.4%

Highest Rental Yields

– HOUSES: Katherine, Northern Territory – Outback: 8.9%

– UNITS: Parap, Hobart: 8.5%

Highest 12-month Change in Values & Rents, Greater Darwin

See more of Northern Territory’s best performing areas

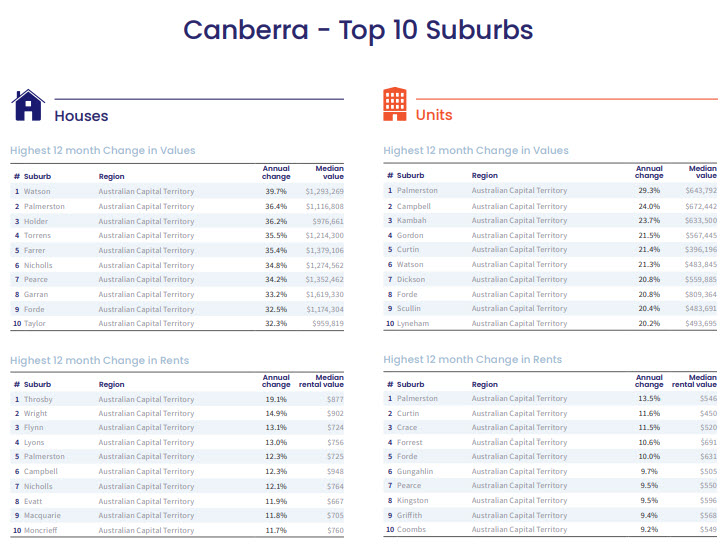

ACT Best Performers for 2021

Highest Median Value

– HOUSES: Campbell, Australian Capital Territory: $1,953,012

– UNITS: Yarralumla, Australian Capital Territory: $1,089,143

Lowest Median Value

– HOUSES: Strathnairn, Australian Capital Territory: $576,477

– UNITS: Lyons, Australian Capital Territory: $376,778

Greatest 12-month Change in Value

– HOUSES: Watson, Australian Capital Territory: 39.7%

– UNITS: Palmerston, Australian Capital Territory: 29.3%

Greatest 12-month Change in Rents

– HOUSES: Throsby, Australian Capital Territory: 19.1%

– UNITS: Palmerston, Australian Capital Territory: 13.5%

Highest Rental Yields

– HOUSES: Wright, Australian Capital Territory: 4.7%

– UNITS: Gungahlin, Australian Capital Territory: 5.8%

Highest 12-month Change in Values & Rents, Canberra

See more of Australia’s Capital Territory best performing areas

To compare this year’s top 10 suburb performers to previous year’s – read our blogs with links to the full CoreLogic report:

- Australia’s top performing suburbs across each capital city for 2020

- Australia’s top performing suburbs across each capital city for 2019

- Australia’s top performing suburbs across each capital city for 2018

CoreLogic’s Best of the Best report for 2021 gives you all the property data you need to track the results of this historic year. The report highlights Australia’s best and worst performing suburbs based on sales, rents and property values, as well as providing a 2020 market review. Download report here.

Source:

– Australia’s Best of the Best 2021 suburbs revealed. 16 December 2021. Read report

– A year like no other, Australia’s best of the best property performers of 2021, CoreLogic. 15 December 2021. Read article

Data Dictionary & Disclaimers

All data highlighted is current as at the 30 November 2021, with the exception of Total Value of Sales data which reflect sales that occurred over the 12 months to 30 September 2021.

Top sales are based on properties that have transacted over the 2021 year to date – please note there may be sales we are not yet aware of due to the lag in reporting times, long settlements and non-disclosures.

Exclusions

– Regions with less than 10 Sales;

– 100 AVM observations;

– 20 Rental observations.

Data Dictionary

Median Sales AVM value – A measure of the median (50th percentile) estimated sales value of all properties based on the hedonic imputation method, irrespective of whether it transacted or not.

AVM observations – The total number of Automated Valuations that have been run.

12 month sales volumes – A count of all transactions over the 12 months.

Total Value of Sales – the total value of all property transactions recorded over the 12 months to September 2021.

12 month change in value – the percentage difference between the hedonic home value index as at 30 November 2021 compared to 12 months ago.

12 month change in rents – the percentage difference between the hedonic rental value index as at 30 November 2021 compared to 12 months ago.

Gross Rental Yields – A measure of the implied yield of properties based on the underlying sales values and ‘for rent’ listings values of properties using the hedonic imputation methodology.

Hedonic Home Value Index – CoreLogic’s headline measure for property market performance. It measures the organic change in underlying sale values of properties using the hedonic imputation methodology. The full detailed methodology description available at:

https://www.corelogic.com.au/research/rp-datacorelogic-home-value-index-methodology.

Hedonic Rental Value Index – A measure of the organic change in underlying ‘for rent’ listing values of properties using the hedonic imputation methodology. The full detailed methodology description available at: https://www.corelogic.com.au/research/rp-data-corelogichome-value-index-methodology.

Subscribe to our newsletter